Financial technology, commonly known as fintech, is one of the most popular areas among software engineering businesses today. Virtually everyone deals with money and payments every day, and creative minds can come up with tons of solutions to improve those interactions. Solutions to people's finance-related needs—like many kinds of solutions in the modern world—can come in the form of software.

Below is an overview of fintech today showing how diverse and full of opportunities the sector is. The overview can become a source of inspiration for people thinking about investing in fintech or starting a business related to it.

Growing of fintech

In 2019, the UK and the US were leaders in fintech adoption, with the UK experiencing a notable surge from 48% to 72%. The 2020 lockdown led to a 72% increase in fintech app usage in Europe. While fintech startups initially received increased funding, the investment landscape shifted in 2020, favoring established firms over emerging ones.

Post-2020, amidst the global pandemic, funding for emerging firms decreased, but early-stage fintech companies, particularly those in seed and pre-seed stages, displayed resilience by securing a 26% increase in funding by 2022. Fintech funding, experiencing a 40% year-over-year decline from $92 billion to $55 billion, remained relatively stable over five years, maintaining a 12% share of total VC funding, with only a marginal 0.5 percentage point decline in 2022.

In conclusion, it can be inferred that post-2020, the fintech sector showcased adaptability to changing conditions, with sustained growth in funding for early-stage development despite an overall decline in investments. The long-term stability and a substantial increase in fintech app usage underscore the industry's significance and resilience in overcoming challenges.

McKinsey's research anticipates fintech industry revenues to grow almost three times faster than traditional banking sector revenues between 2023 and 2028, projecting annual growth of 15% compared to the 6% growth for traditional banking.

Despite inflation concerns, 83% of businesses cut unnecessary expenses, with tech budgets expected to grow by 13% in 2023. Fintechs that embraced technology modernization thrived, viewing tech as a source of returns. In summary, the fintech industry faced challenges but capitalized on growth opportunities in 2023.

Over time, the trend developed, and by 2023, the following changes occur. Therefore, it is essential to highlight the development of blockchain and AI separately.

The fintech blockchain market, valued at $3.17 billion in 2023, is projected to reach $21.67 billion by 2028, showing an impressive annual growth rate of 46.92%, driven by increased demand for cryptocurrency and Initial Coin Offerings (ICOs). The U.S. holds a dominant 54% share in the market, and a UNCAD report predicts that the U.S. and China will jointly contribute 75% of future patent applications, highlighting their anticipated dominance.

The AI in fintech market, valued at $42.83 billion in 2023, is projected to reach $49.43 billion by 2028, with a dominant 77.5% contribution to global revenue. AI enhances financial service revenue by 34% and plays a pivotal role in combating fraud. With 32% of fintech companies already leveraging AI, 90% globally rely on artificial intelligence and machine learning. North America leads with over 40% revenue share, while the Asia Pacific anticipates rapid CAGR growth between 2022 and 2030, driven by increased reliance on AI-powered mobile devices in fintech.

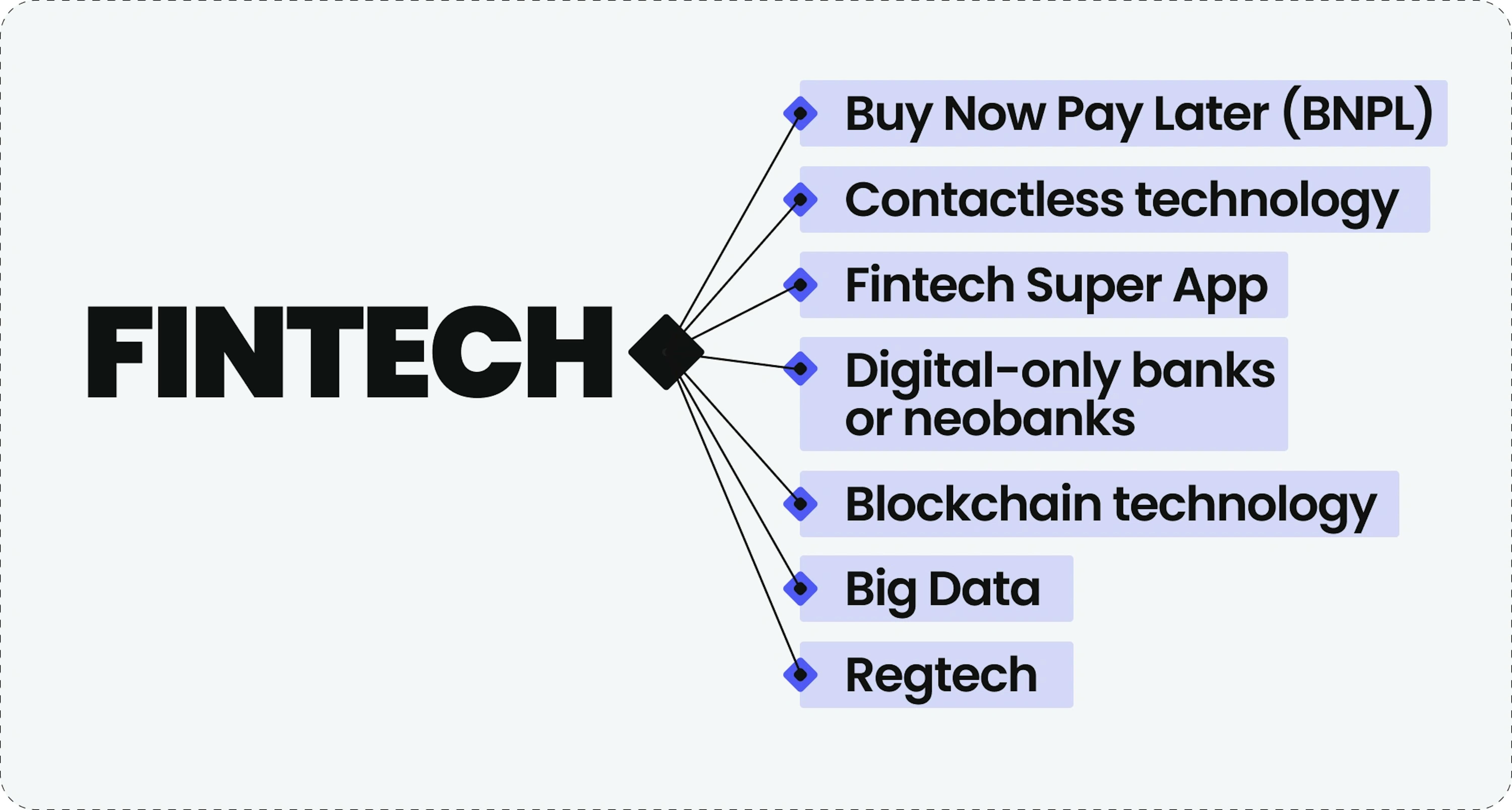

Trends of fintech areas

The most recent advancements in financial technology are shaped by digital finance trends, often propelled by emerging technologies such as AI, ML, and blockchain. These trends are responsive to consumer preferences and shifts in regulations.

Buy Now Pay Later

Buy Now, Pay Later (BNPL) stands as a prominent fintech innovation, experiencing rapid growth, according to Business Insider. This trend allows consumers to defer payments for online or in-store purchases, and the global BNPL market is predicted to surge from $24 billion in 2020 to $67 billion by 2025. BNPL's popularity stems from its convenience for customers in managing finances, its potential to drive sales and foster customer loyalty for businesses, and the competitive interest rates and payment terms offered by BNPL companies.

Contactless technology

Contactless technologies in fintech are surging as consumers demand faster, more convenient payment methods. Widespread NFC technology in mobile devices, led by major players like Apple Pay and Google Pay, propels contactless payments. In 2024, expect the progression of the contactless payment trend towards increased accessibility and adoption. Soft POS, alternatively termed tap-to-mobile or tap-to-phone, enables merchants to utilize their smartphones to accept contactless payments. Globally, it is anticipated that soft POS will experience a substantial compound annual growth rate (CAGR) of 20.4% until 2030, reaching a total of $1,077 million.

Fintech super app

The surge of fintech super apps is a significant trend, featuring versatile applications that offer diverse services to a broad user base. These all-in-one solutions are disrupting the fintech industry by capitalizing on innovation opportunities.

Factors driving their popularity include providing a convenient one-stop-shop for fintech needs, a vast network of partners for varied services, and a mobile-first approach to align with increased smartphone usage. Fintech super apps often have lower entry barriers, utilizing existing platforms like messaging or social networks, facilitating user onboarding. Their agility enables quick adaptation to evolving user needs and industry demands.

Digital-only banks or neobanks

Digital-only banks, commonly called neobanks, operate exclusively online and provide various financial services, including checking accounts, savings accounts, and loans. Renowned for their convenience, user-friendly interfaces, and competitive fees, these banks offer round-the-clock accessibility through intuitive websites and mobile apps. Despite their advantages, digital-only banks may require more physical branches and a broader array of financial products when compared to traditional banks.

Blockchain technology

Blockchain, a rising fintech trend, has significant potential. In a Deloitte survey, 76% foresee digital assets replacing fiat money in 5-10 years. It offers data protection, verification, identification, and enhanced traceability. Decentralized finance (DeFi) challenges centralized systems, reshaping finance from trading to insurance. Proponents argue it can reduce risks of financial crises by reducing reliance on large banks. Blockchain ensures data integrity, transparency, and transaction security, with over $40 billion in assets in cryptocurrencies and DeFi. It stands as a key fintech trend for the future.

💡 Ever wondered why major banks like JPMorgan and Citi are investing heavily in blockchain? Explore how this technology is transforming everything from cross-border payments to fraud prevention in our article.

Big Data

Big Data is pivotal in finance, using vast datasets to predict behavior and shape strategies. Financial technologies leverage it to predict customer behavior and conduct advanced risk assessments, distinguishing them from traditional institutions. In 2024, anticipated benefits include enhanced decision-making from structured data and valuable analytical insights from diverse unstructured sources:

- Customer focus. Big Data enables precise customer segmentation for tailored solutions.

- Data security. In addressing digital banking fraud, Big Data aids in developing accurate fraud detection systems by identifying suspicious activities.

- Risk assessment. Fintech companies can operate with increased financial confidence, manage cash flow effectively, and offer competitive fees through enhanced risk assessment.

- User experience improvement. By swiftly identifying customer needs and behaviors, companies can provide faster and more accurate solutions, improving the overall user experience.

Regtech

Regulatory compliance challenges banks with complex and costly processes due to numerous regulations. Companies incur expenses for legal support or non-compliance fines amid rule complexity. The expanding regulatory landscape fuels demand for Regulatory Technology (RegTech), offering automated solutions for monitoring financial operation correctness and legality.

Regtech tasks include client identification, data processing, protection, and financial risk analysis. Regtech automates extensive regulatory requirements for each business line through automation, Big Data, and ML integration. These solutions analyze historical data patterns, aiding in identifying problematic cases and detecting fraud using regulatory technologies.

Future trends

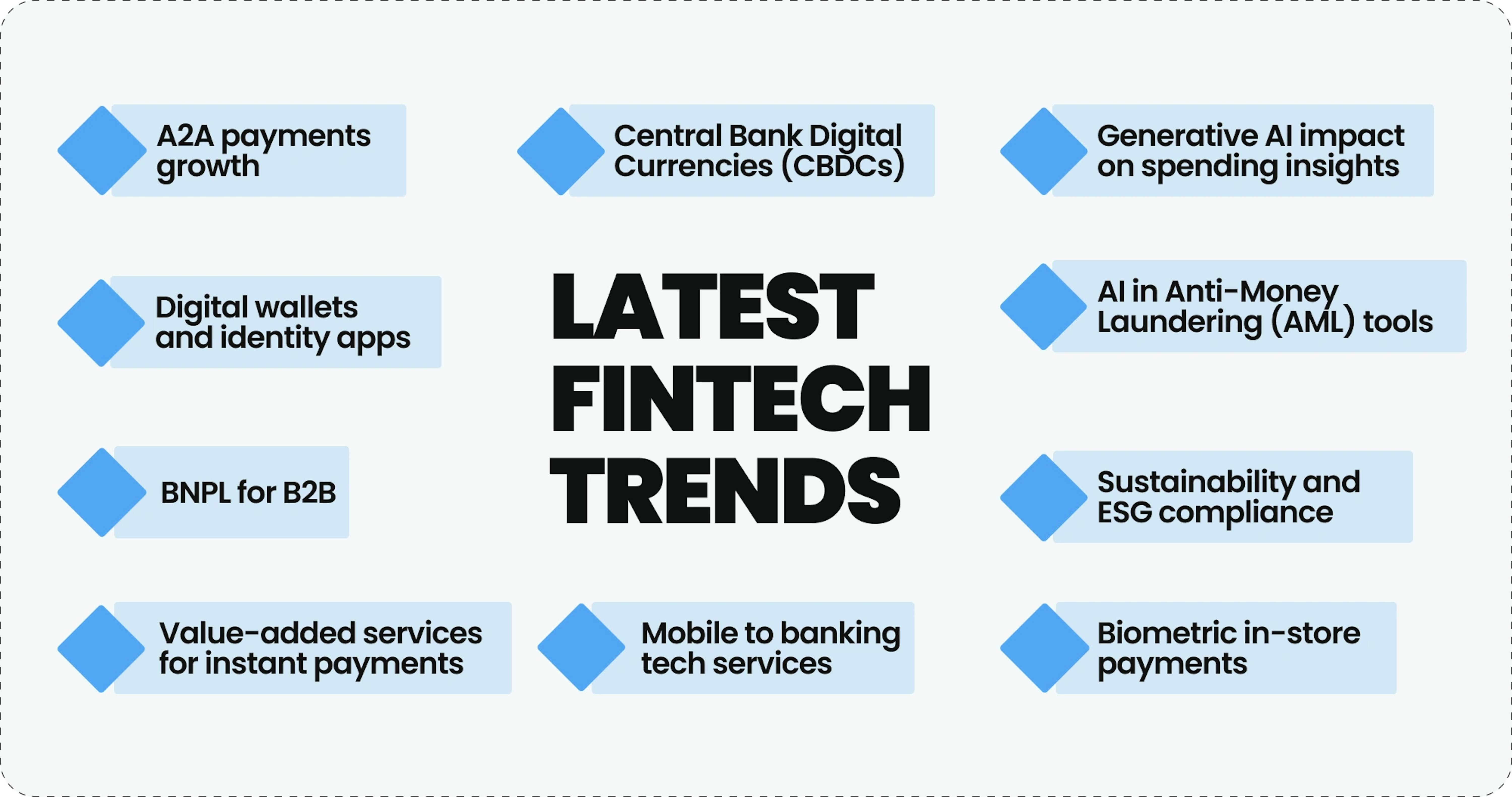

In 2024, significant trends are expected in the FinTech landscape:

The Juniper report provided most of the data for this block. If you are interested, you can study this report yourself.

A2A payments growth

A2A payments, particularly in regions like India, Brazil, and China, are set to surge, driven by open banking, instant payments, and merchant support. Juniper predicts that A2A payments offer advantages such as cost-effectiveness, speed, and lower fraud risks.

Central Bank Digital Currencies (CBDCs)

Following a pivotal 2023 for CBDCs, 2024 is anticipated to witness substantial market growth, especially in cross-border and B2B payments. Juniper forecasts an extraordinary 213,000% increase in global CBDC transaction value by 2030 as governments adopt digital currencies.

Generative AI impact on spending insights

Generative AI is poised to revolutionize spending insights for financial institutions globally. With increasing customer data availability and heightened competition, banks and credit unions are expected to focus on providing personalized, user-friendly experiences tailored to consumer needs.

💸 AI-first products reimagine financial services from scratch, not just as add-ons. In our new article learn how this shift can transform your offerings.

Digital wallets and identity apps

Between 2024 and 2026, a notable 86% global growth in digital identity apps is projected. Initiatives like the EU ID Wallet indicate a move towards digital identities. Digital wallets are already incorporating features like digital driving licenses, with Apple leading the way.

AI in Anti-Money Laundering (AML) tools

Global spending on regtech is anticipated to grow 150% from 2023 to 2028. AML tools leveraging AI are expected to play a crucial role in making compliance with complex regulatory requirements faster, more cost-effective, and more efficient. Juniper predicts focusing on advanced AI-powered AML systems in 2024 to keep pace with evolving payment landscapes.

Although these five trends may exert an insignificant impact in 2024, it is essential to acknowledge that they still warrant observation and strategic planning.

Sustainability and ESG compliance

Sustainability and ESG (Environmental, Social, and Governance) compliance are related concepts that focus on the responsible and ethical practices of companies. Anticipated rise in tech initiatives addressing ESG issues, like recycled plastics in cards, solutions for the impaired, and money management for the less affluent.

Value-added services for instant payments

Value-added services (VAS) go beyond core products, offering extra benefits to enhance user experiences and differentiate companies. In telecom, features like caller ID and voicemail are examples; logistics may include assembly and shipment tracking. Banks exploring FedNow-based VAS in 2024, focusing on A2A use cases, wallet top-ups, embedded finance, and B2B payments.

Mobile to banking tech services

Shift from P2P transactions to advanced banking-like services in the payments space. Mobile Financial Services (MFS) providers seek partnerships with banks for tailored offerings.

Biometric in-store payments

Developments like Amazon One's contactless biometric system drive the growing use of biometric solutions for payments. Enhanced security and a seamless experience are key benefits.

BNPL for B2B

Foreseen expansion of Buy Now, Pay Later (BNPL) options for SMEs, meeting growing liquidity needs. Amazon's partnership with Affirm highlights the move towards BNPL in the B2B segment.

Conclusion

In conclusion, the fintech industry has experienced remarkable growth and adaptation, propelled by technological innovations and changing consumer preferences. The surge in fintech adoption, evident in the UK and the US, highlights the sector's significance.

During this period, the fintech landscape has seen substantial shifts, with the emergence of disruptive trends, contactless technology, fintech super apps, digital-only banks, blockchain, etc. These trends respond to consumer needs, regulatory challenges, and the evolving financial ecosystem.

Looking forward, significant trends are expected to shape the fintech landscape in 2024, including A2A payments growth, the rise of CBDCs, the impact of generative AI on spending insights, the growth of digital wallets and identity apps, and the integration of AI in ML tools.