When a company adopts a hybrid, multi-cloud approach, it may struggle to optimize value and control cloud spend. One of the solutions in this situation would be FinOps.

FinOps is the movement that has evolved spontaneously worldwide due to the environment created by on-demand cloud resources encountering no longer relevant technology management methodologies. This is a cultural shift and set of processes that have been called other names and probably will be called different names in the future.

Early cloud adopters like Adobe and Intuit pioneered what is now known as FinOps around 2012 in San Francisco. Later, companies in Australia, such as Qantas, embraced similar practices, and by 2017, enterprises like BP and Sainsbury's in London were developing FinOps across their cultures.

FinOps emerged later. Initially, it was called "cloud cost management" or "cloud cost optimization." AWS and others used "cloud financial management" before adopting FinOps, highlighting its cross-functional approach, akin to DevOps.

Today, FinOps is going global, with companies like Nike and Southwest Airlines establishing FinOps roles and tech giants like Atlassian integrating it into their operations.

This article is a comprehensive overview of FinOps, covering its definition, importance, and benefits. It delves into how FinOps optimizes cloud spending, outlining its principles and capabilities. The article also discusses the current status of FinOps, the role of the FinOps team, challenges during implementation, and best practices for efficient cloud spending management.

What is FinOps, and why do you need it

According to a report released by Flexera, the number of executives using the cloud in 2023 is higher than was expected. They also noted that 32% of the organization's cloud spend is wasted.

FinOps is a shorthand term for financial operations, which doesn't necessarily refer to cloud computing. In theory, FinOps principles can be applied to any type of environment, but they are almost exclusively associated with cloud-based cost optimization. This practice is carried out through a collaboration between the finance, distributed tech, and business teams. They can fine-tune the deployment of their cloud solutions to meet their business objectives.

By implementing the FinOps framework, organizations can improve their agility and increase innovation. One of the most important factors they can consider when it comes to improving their cloud spend is transparency and forecasting.

In short, finance, technology, and business are brought together in FinOps to master the unit economics of cloud computing and create an operating model for efficient cloud utilization. To increase efficiency and meet budgetary and financial requirements, users of cloud resources are given responsibilities for planning and managing capacity, goals, and variable usage of cloud resources.

When should you start FinOps? Depending on a company's needs and circumstances, FinOps can be implemented at any time. Although FinOps practices generally recommend to start implementing them as soon as possible. Consider these key factors:

Cloud adoption stage. It is ideal to start FinOps practices early in cloud adoption or migration. This allows companies to establish cost management processes and optimize spending. By implementing FinOps early, companies can avoid potential cost overruns and ensure financial accountability.

Increasing cloud spending. If a company's cloud spending is growing rapidly or has reached a point where it is becoming a significant portion of the overall tech budget, it may be a good time to start FinOps. Implementing FinOps practices can help manage and optimize the increasing cloud costs effectively.

Lack of cost visibility and control. When a company lacks visibility into its cloud costs or struggles to control spending, it indicates that FinOps practices are needed. FinOps can provide the necessary tools and processes to gain cost visibility, allocate expenses accurately, and implement cost-saving measures.

Budget constraints or cost optimization goals. If a company has budget constraints or specific cost optimization goals, starting FinOps can help achieve these objectives. FinOps focuses on optimizing cloud spending and making data-driven decisions to reduce costs while ensuring the availability and performance of cloud resources.

Major changes or growth initiatives. When a company is undergoing major changes or embarking on growth initiatives that involve cloud resources, it is a good time to start FinOps. This ensures that cost management practices are in place to support these initiatives and prevent unnecessary spending.

So, we can say that FinOps is a strategic approach that optimizes cloud spending through collaboration among finance, technology, and business teams. By embracing FinOps principles, organizations can enhance agility, innovation, and financial accountability. The key lies in early implementation, especially during cloud adoption, increased cloud spending, lack of cost control, budget constraints, and significant growth initiatives. Ultimately, FinOps empowers companies to master the economics of cloud computing and achieve efficient cloud utilization.

What are FinOps principles

The six core principles of the FinOps Foundation are designed to guide the activities of the organization's finance and technology teams. As teams start to use cloud services, these principles are regularly updated and adjusted. They aim to help teams make informed decisions and maximize the value of their data. The following are:

1. Tech-wide cross-function support

The collaboration of teams is essential in order to achieve efficiency. In FinOps, the goal is to make sure that all of the teams are working together seamlessly to improve the efficiency of the organization. One of the most critical factors that can be considered when it comes to improving the efficiency of the organization is the establishment of effective controls and governance for the use of cloud optimization services.

2. Business value drives cloud decisions

The cloud provides many advantages to developers, as it allows them to enhance their business features and reduce their time to market. It also allows them to quickly provision resources and manage their operations. However, it is not just about tracking the costs of the cloud. With FinOps, you can make decisions that will increase the value of the cloud.

3. Everyone takes ownership of their cloud usage

Each team within an organization should be responsible for its own cloud costs. Having in-depth visibility into these expenses will allow you to identify areas where you can improve your efficiency. Developers and other team members who are involved in the creation of software should also be held accountable for their spending. They should be able to perform rightsizing exercises and decommission unused resources.

4. Form a centralized FinOps team

A centralized FinOps team that is responsible for developing and implementing a cloud strategy should be able to set cost-efficiency expectations and provide engineering teams with the necessary cloud cost optimization tools and resources to improve their efficiency. This group should also help them develop cost-effective practices and manage their budgets.

5. Create easily accessible FinOps reports

One of the most important factors that you should consider is having a cost report and cloud optimization services that are available to all of your engineering teams in real time. This will allow them to monitor their cloud usage and make informed decisions. Another important aspect of this is an anomaly detection system that will allow you to notify them when something goes wrong immediately.

6. Take advantage of the variable cost model of the cloud

With the availability of new resources, it is easy to provision them in the cloud. However, it is important to be aware of the costs associated with this technology and ensure that you are using the resources efficiently. One of the most effective ways to minimize these expenses is by continuously monitoring the usage of your current resources. This will allow you to align your budget with the costs of your cloud. Another important factor you should consider is implementing cost-efficient practices such as rightsizing resources and purchasing reserved instances.

The FinOps Foundation's six core principles provide a roadmap for finance and technology teams to optimize cloud usage. Collaborative cross-functional support, business-driven decisions, individual ownership of cloud costs, centralized FinOps teams, accessible reports, and leveraging the cloud's variable cost model collectively enable organizations to enhance efficiency, value and informed decision-making in cloud management.

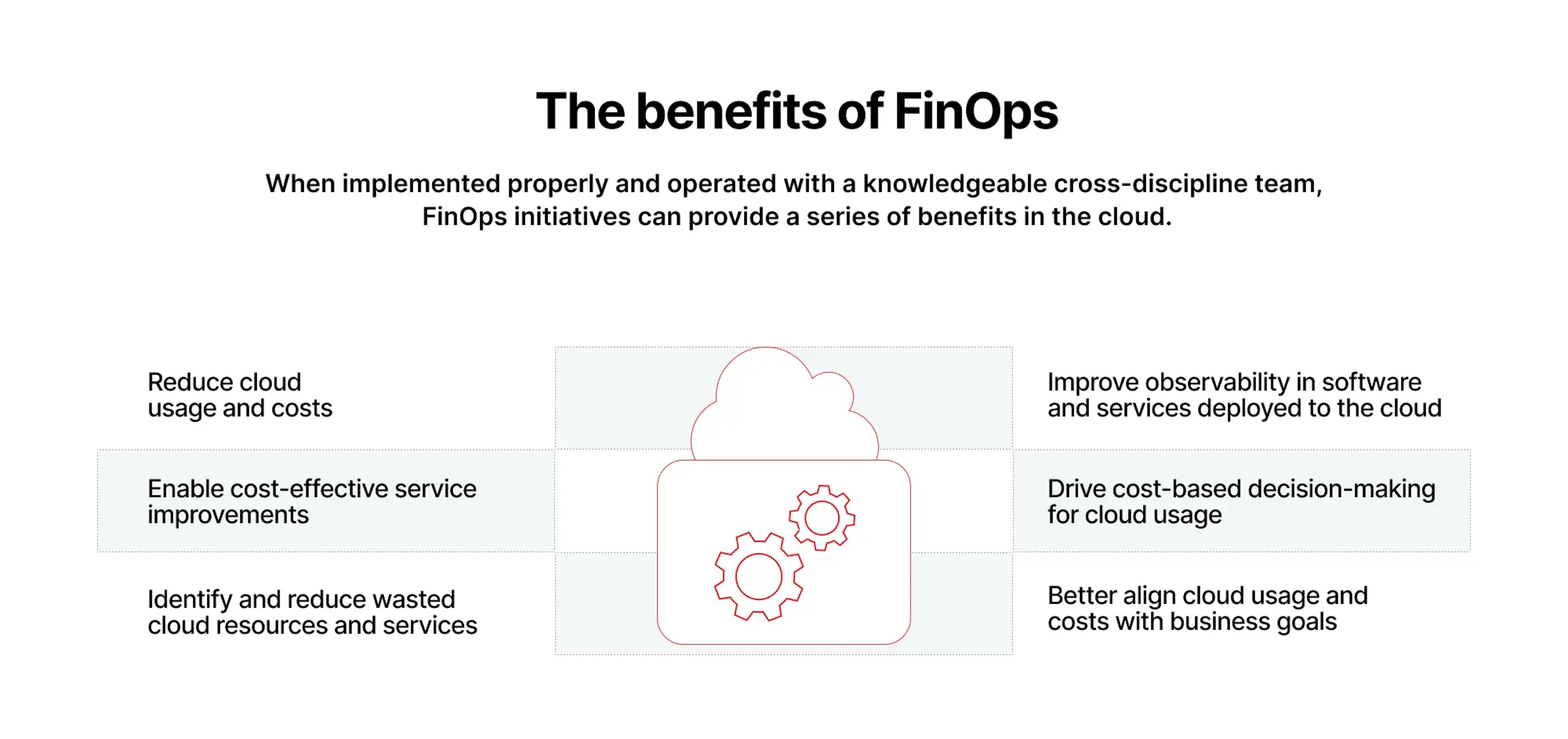

How can FinOps help optimize cloud spending

Optimizing cloud spending has become a paramount concern for businesses as they navigate the dynamic landscape of cloud computing. Let's explore how FinOps can substantially influence optimizing cloud expenditure by employing tactics, procedures, and cooperative efforts.

Cost visibility and transparency

FinOps provides tools and processes to gain visibility into cloud costs. This includes tracking and analyzing spending at a granular level, understanding the cost drivers, and identifying areas of inefficiency or waste. With better visibility, companies can make informed decisions to optimize spending.

Cost allocation and accountability

FinOps helps allocate cloud costs accurately to different teams, projects, or departments. This enables companies to understand who is responsible for the spending and encourages teams to be accountable for their cloud resource usage. By attributing costs to the right stakeholders, companies can optimize resource allocation and identify opportunities for cost savings.

Real-time monitoring and optimization

FinOps enables real-time monitoring of cloud spending, allowing companies to identify any unexpected cost spikes or patterns. With this information, companies can immediately optimize spending, such as rightsizing instances, scaling resources appropriately, or implementing cost-saving measures.

Data-driven decision-making

FinOps promotes a data-driven approach to cloud spending. By analyzing cost data and usage patterns, companies can make informed decisions on resource utilization, pricing models, and optimization strategies. Data-driven insights help identify opportunities for cost savings, negotiate better contracts with cloud providers, and make smarter decisions around reserved instances or spot instances.

Collaboration and governance

FinOps brings together finance, engineering, product, and management teams to collaborate on cloud spending optimization. It establishes processes, communication channels, and governance frameworks to align cloud spending with business objectives. By working together, teams can optimize spending based on the needs of the business and ensure financial accountability.

Continuous improvement

FinOps is an ongoing process of continuous improvement. It involves regularly reviewing and optimizing cloud spending based on changing business needs, market conditions, and technological advancements. By continuously monitoring and optimizing spending, companies can optimize long-term costs and maximize the value they get from their cloud investments.

In the intricate world of cloud computing, where costs can spiral if not managed effectively, FinOps emerges as a guiding light. By enhancing cost visibility, enabling real-time monitoring, promoting accountability, and fostering data-driven decision-making, FinOps empowers businesses to optimize cloud spending with precision. As companies embark on this journey, they embrace both cost-efficient practices and a culture of collaboration and continuous improvement, ultimately reaping the rewards of financial savings and operational excellence.

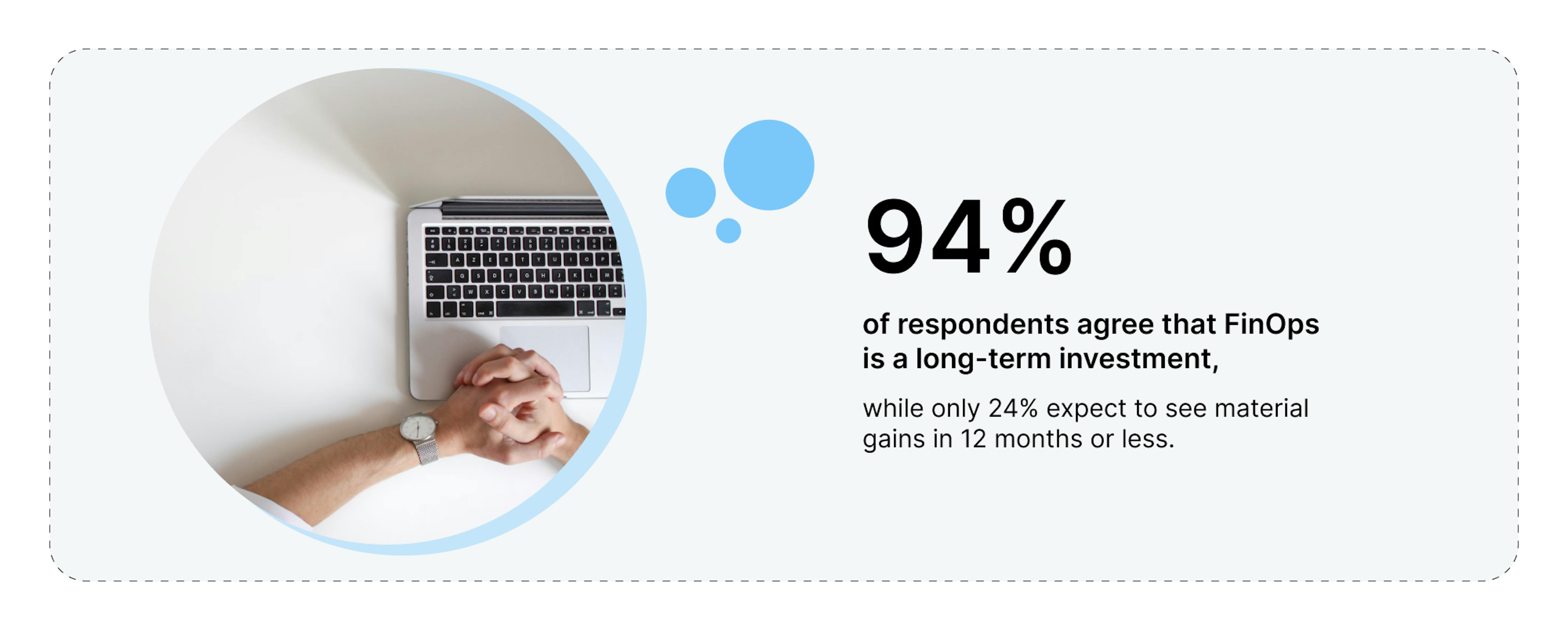

What is the evidence of FinOps

According to the study conducted by the Boston Consulting Group, over 70% of the digital transformations that are carried out today fall short of their goals. This is why it is important that cloud spending is regularly monitored and analyzed. The rise of cloud computing has brought about various benefits, such as agility, demand-based consumption, and decentralized control. However, with the increasing number of hybrid and multi-cloud offerings, organizations are struggling to manage their spending. A cloud cost center of excellence can help the organization understand the various aspects of its cloud strategy.

The FinOps framework aims to help engineering teams manage their spending while still empowering them with agility and speed. It empowers engineering teams with agility while fostering cost consciousness. It encourages considering costs and quality. Though cultural change is challenging, the approach offers benefits. It fosters transparent financial policies, trust, and collaboration among departments and teams.

Through the use of a carefully analyzed trade-off between speed and quality, cloud cost management can help break down the functional barriers between the various teams.

What are the capabilities of FinOps

The capabilities of a FinOps organization are defined as areas of activity designed to support its business's various functions. These activities are typically performed to support the FinOps domain's maturity improvement and education. In addition to meeting their customers' needs, these activities help them develop effective and efficient knowledge-sharing and business objectives.

The first FinOps capability is understanding fully loaded costs. Before accurately allocating cloud costs to the engineering teams, the billing data must be mapped to the organizational hierarchy, such as the cost centers, business units, applications, and environments. Accounts, projects, and tagging often do not fully align with how leadership and Finance think of cloud spending. Also, untaggable cloud resources like data transfer costs must be apportioned to provide a complete view of cloud costs.

The second FinOps capability is real-time decision-making. The FinOps team needs to build timely and consistent reports that provide spending data to stakeholders. These reports must be customized to whoever is viewing them, ideally automatically. Spend anomalies like cost spikes and cloud waste or potential savings opportunities like underutilized services must promptly be communicated to the right people.

The third FinOps capability is benchmark performance. The FinOps team needs to incorporate trending and variance analysis in their reports. Looking at spending data at a point in time is not as useful as looking at a progression over time. Leadership and engineers will need custom reports to show business metrics and KPIs like cost per active customer, cost per widget sold, or cost per streaming hour. The FinOps team also needs to reach out to other companies to evaluate their capabilities against current practices in the industry.

The fourth and fifth FinOps capabilities are rate reduction and cost avoidance. Rate reduction refers to anything that reduces cost from public or list pricing, for example, enterprise agreements, private pricing agreements, reservations, and savings plans. Cost avoidance refers to any effort that reduces usage, like right-sizing, cloud parking, auto-scaling, and re-architecting workloads to be more cloud-native to take advantage of containers or serverless.

In the early stages, without infrastructure as code (IaC) practices, companies can easily forget about their services and VMs until the bill arrives. On the other hand, in the mature stages, companies have to face expenses that are not only related to one issue but also require a long-term strategy to improve their infrastructure. One of the most prominent examples is our case — Veeqo, an inventory and shipping platform for e-commerce. You can read a comprehensive case study here.

Last but not least, the sixth FinOps capability is aligning plans to the business. The FinOps team needs to have ongoing reviews with stakeholders about optimization opportunities to drive cost avoidance. In addition, the FinOps team needs to develop a framework for decision-making that aligns with the business drivers. This moves cloud cost to the forefront of everyone's thinking.

FinOps capabilities span understanding costs, real-time decision-making, benchmarking, rate reduction, cost avoidance, and business alignment. These practices optimize cloud spending, enhance decision frameworks, and drive alignment, ensuring efficient cloud financial management.

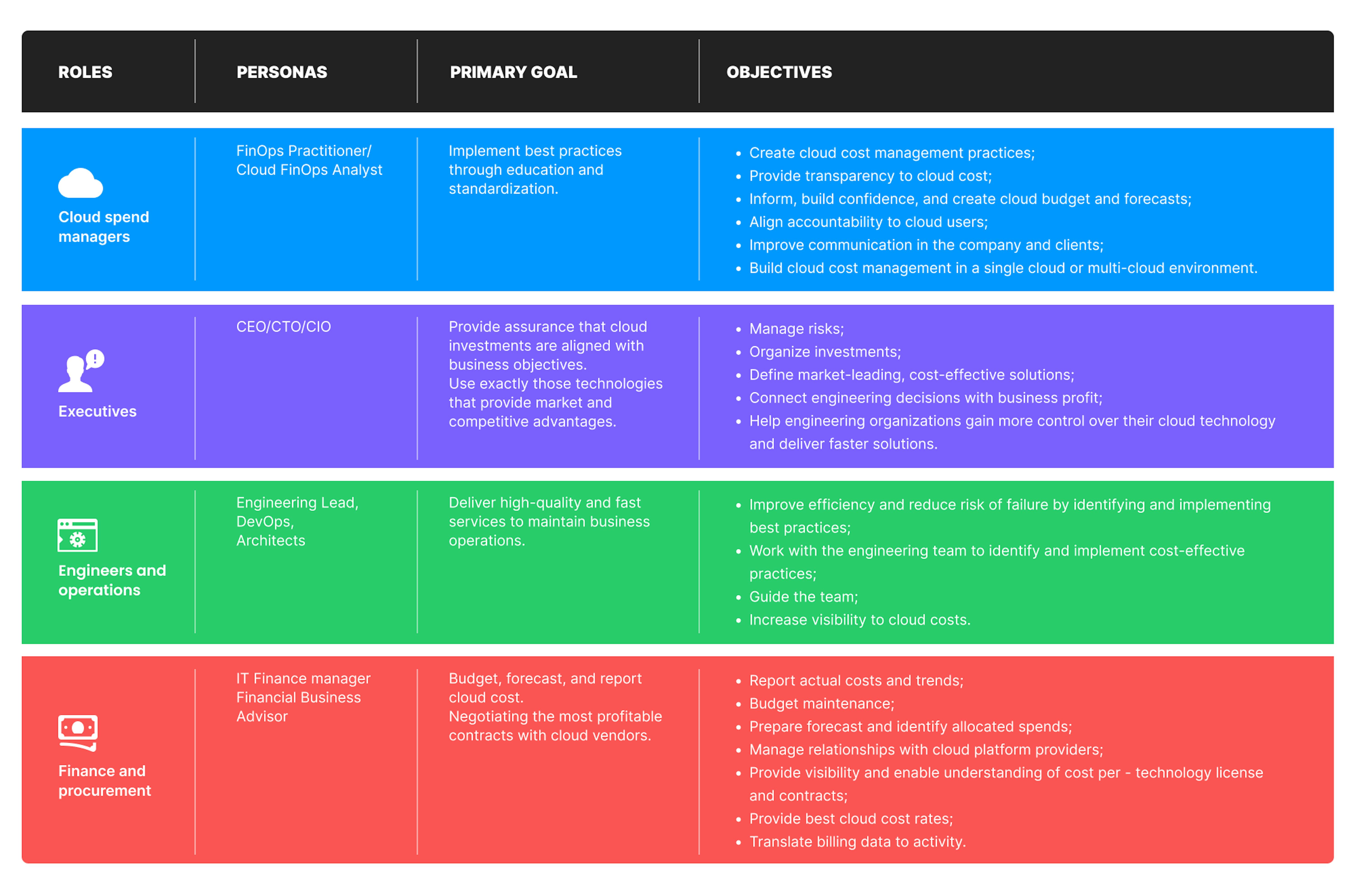

FinOps team and responsibilities

Before an organization can adopt a FinOps function, it must first establish a set of personas that the executive team will use to gain approval and participation. This will help the team members identify the goals and implement the necessary changes.

The executive team personas are designed to represent the various goals and concerns of the organization's executive team. They can also be used to communicate key messages and implement the necessary changes.

Core stakeholders of cloud financial management

If you have difficulty choosing the right technologies or roles for your project, fill out the form to contact us. We will then arrange a free consultation to discuss the project's goals and ideas.

What challenges do companies typically face when implementing FinOps

Managing cloud expenses is paramount as companies embrace hybrid environments and navigate complex billing models. This part will discuss companies' hurdles in achieving cost optimization through FinOps principles and present practical solutions.

| Challenges | Solution |

|---|---|

| Lack of visibility and control One of the primary challenges is the lack of visibility and control over cloud expenses. Many companies struggle to understand where their cloud costs are coming from and how to manage and optimize them effectively. The survey report states in 2022, 94% of tech leaders report their cloud storage costs are rising, and 54% confirm their storage spend is growing faster than overall cloud costs. | Invest in cloud cost management tools Invest in cloud cost management tools that provide real-time monitoring, reporting, and alerts for better visibility into cloud expenses. Implement tagging and labeling strategies to track costs accurately and allocate them to specific teams or projects. |

| The complexity of cloud billing Cloud billing can be complex, with multiple services, pricing models, and usage patterns. It can be challenging for companies to accurately allocate and track costs across different business units, teams, and projects. Over half of tech executives say cloud costs are difficult to manage. | Train and educate employees Train and educate employees on FinOps principles and best practices. Consider hiring or upskilling individuals with FinOps expertise to lead and drive the implementation of cost optimization strategies. |

| Siloed teams and lack of collaboration Implementing FinOps requires close collaboration between finance, tech, and business teams. However, companies often face challenges in breaking down silos and fostering effective communication and collaboration between these teams. 68% of survey respondents stated that their teams operate silos. This highlights the challenge of siloed teams and the lack of collaboration within organizations implementing FinOps. | Foster collaboration between teams Foster collaboration between finance, tech, and business teams by establishing regular meetings, sharing insights and reports, and aligning on cost optimization goals. Encourage cross-functional teams to work together to identify cost-saving opportunities and implement best practices. |

| Resistance to change Implementing FinOps often requires changes in processes, tools, and organizational culture. Some employees may resist these changes, leading to challenges in driving adoption and achieving buy-in from all stakeholders. | Promote a culture of cost optimization Encourage a culture of cost optimization by setting clear cost reduction goals, recognizing and rewarding cost-saving initiatives, and integrating cost optimization into performance metrics and KPIs. |

| Inconsistent data and metrics Companies may face challenges in obtaining consistent and accurate data on cloud usage and costs. Without reliable data, it can be difficult to make informed decisions and take effective actions to optimize cloud spending. | Establish cloud governance policies Establish cloud governance policies to ensure responsible cloud usage and cost optimization. Define guidelines for resource provisioning, utilization, and budget allocation. Regularly review and optimize these policies based on the organization's evolving needs. |

| Lack of FinOps tools and automation Companies may struggle to find suitable tools and technologies to support their FinOps initiatives. The lack of automation and analytics capabilities can hinder the ability to track, analyze, and optimize cloud costs effectively. | Optimize cloud architecture Regularly assess and optimize cloud architecture and resource allocation to ensure efficient utilization and minimize wastage. Consider using reserved instances or spot instances for cost savings opportunities. FinOps impact on the business can be accelerated by leveraging the right tools and encouraging a culture of shared responsibility—no one can afford to fall behind while waiting 2-3 years or more. |

| Regulatory and compliance considerations Companies operating in regulated industries may face additional challenges in implementing FinOps while complying with industry-specific regulations and data privacy requirements. | Leverage FinOps best practices Adopt established FinOps frameworks such as the FinOps Foundation's "Four Pillars of FinOps" (Inform, Optimize, Operate, and Align). Follow best practices shared by the FinOps community and participate in industry events and forums to stay updated on the latest trends and strategies. |

Today, mastering the art of FinOps is no longer a choice but a necessity. As organizations strive to balance innovation and financial prudence, addressing challenges related to visibility, collaboration, culture, and tools is essential. To achieve efficiency, compliance, and improved cost control in the cloud, businesses can embrace FinOps frameworks, foster collaboration, leverage data insights, and promote shared responsibility.

What are FinOps best practices for managing cloud spending

FinOps aims to create an organization's accountability culture, which can take time and patience. Before you start implementing a strategy, you must identify the project's opportunities, goals, and priorities and develop KPIs to help everyone take ownership of their cloud spending. This will allow you to make informed decisions and improve the efficiency of your organization.

Although implementing a FinOps strategy can be easy, achieving success is not always easy. Many factors can affect a FinOps initiative's success, and implementing the right practices can help organizations overcome these challenges. Here they are:

The success of FinOps depends on the team's commitment to the project and its cross-disciplinary approach. This is why it is important that all members are committed to the initiative. Besides being able to work together seamlessly, the team members also need to maintain a strong culture of commitment.

One of the most important factors you should consider when implementing a cloud cost management strategy is the availability of a single tool that can provide the team with the necessary information to make informed decisions. This tool can be used in a variety of cloud platforms.

Establish a comprehensive cost-allocation framework. This can be done using various tools, such as cloud resource tagging.

Consider the cost-per-transaction or cost-per-customer metric. For instance, if the cost of cloud services increases by 12% after implementing an important workload, but the increase in transactions and customers can be offset by the workload enhancements, then the overall cost of the solution might be lower.

Don’t forget about continuous monitoring of the utilization of cloud services. This will allow you to identify areas where you can reduce waste.

Successful implementation of a FinOps strategy requires commitment, cross-disciplinary collaboration, and the right tools. Creating a culture of accountability and ownership and establishing comprehensive cost allocation frameworks and continuous monitoring are essential for overcoming challenges and achieving efficiency in cloud cost management. By following these practices, organizations can ensure informed decision-making, optimize spending, and enhance overall cost-effectiveness in their cloud operations.

To sum up

The complexity of the cloud can be a serious cost management challenge for businesses. Various pricing models and varying levels of resources can be used for each service. In addition, the lack of control over the usage of resources can lead to a spiral out of control.

Businesses need to establish a disciplined and collaborative approach to effectively utilize and pay for cloud services. The FinOps framework is a set of practices designed to help organizations manage their cloud costs.

To summarize:

- Everyone has a part to play and should become cost-aware.

- The core principles of FinOps should be the foundation of all processes around cloud financial management.

- Real-time reporting gauges your current spending and optimizations.

- Data-driven processes are key to an organization becoming cost-efficient.

- Business decisions can accelerate and match the rate of cloud resource decisions.